This may not be a problem for most of you, but has been more than a few times for me. I just want to help those out there having the same problem. So, I'll explain the issue through my own experience.

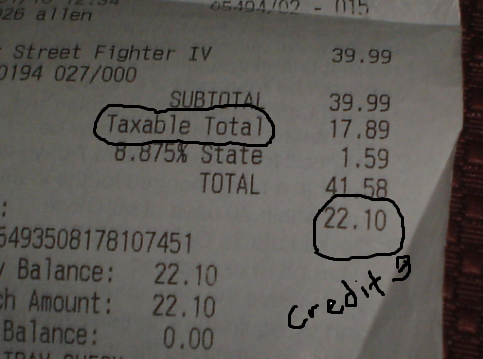

A few days before Pokémon HeartGold and SoulSilver arrived I decided to sell some games and reserve my copy. The game released at $39.99 and I traded in about $20 worth of games. I chose to pay the rest off right there and then, and had to pay about $22, the appropriate amount. Since I paid off $20 with the games I traded in, they are only allowed to tax the remainder. I'm rounding up, but tax on the $19.99 is about $2.

However, when I went to pick my game up on Sunday morning, they said I still owed another $2. This was weird, because I asked to pay off the whole game, but this extra $2 was apparently the remainder of the tax I "never" paid off. I tried to explain my case, but the cashiers were obviously too stupid to know what a taxable difference is. I was tired, it was early in the morning, and I didn't want to say the things I wanted to say an hour before Church. I let it go and was screwed out of $2. I will never let that happen again.

GameStop's slogan is that they "Buy, Sell, Trade used games." It's called a sales tax, not a trade tax. You're selling games to them. If anything, you should be taxing them. Next time you sell games to GameStop and put it towards something, make sure they tax you the appropriate amount. If you buy a $60 game with $60 in credit, you should pay NOTHING in tax.

P.S. This is the tax in New York City. I don't know the difference in rules from state to state, if any.

P.P.S. The picture above is not the receipt from the story above, but is a receipt of an instance where I was appropriately taxed.