It's always interesting to watch the ups and downs of game publishers and developers on the stock market. Gamers often invest a lot, emotionally, on their favorite studios, but investors put hard cold cash where their mouth is, which makes their reaction to a company's announcements quite relevant.

Japan is a nice study case even because in the land of the Rising Sun it's not unlikely at all, for gamers to invest in their publishers of choice and to manifest their plasure or displeasure on a slightly larger scale than a forum rant, by buying or selling stock. Now that Tokyo Game Show 2011 is in the past, it's a good chance to see how Japanese investors reacted to it's events for the major hardware manufacturers and software publishers. First if all, I'll spend a few lines explaining some basic concepts about the Tokyo Stock Exchange (also called Tokyo Shoken Torihikijyo), just to put everything in the right perspective.

The TSE is open every day of the week besides Saturday, Sunday and national holidays. This part actually interests s us because today the TSE is closed due to the Autumnal Equinox holiday (providing a nice, enclosed time frame to study) and Monday was a national holiday as well (the Respect for the Aged Day). This means that after the two business days in which most of the hard-hitting announcements have been made (the 15th and the 16th), the Stock Exchange has been on hiatus three whole days, thing that might have cooled down the effect of some of those announcements a little.

The Tokyo Stock Exchange has trading sessions from 9 to 11 AM and from 12:30 to 3 PM. This is why, in the graphs that will follow, there's a hole in the middle of each day (if you didn't figure this out by yourself).

Another crucial concept is that nothing in the stock market happens in a vacuum. Even if we're talking about the gaming industry, stocks aren't influenced only by reactions to gaming-related announcements, but also by the trends of the stock market as a whole, of the other stock markets, and by what happens in the world's economy. This means that the more a company acts on the international market, the more it's stocks will be influenced by what happens overseas, and the more it branches beyond gaming, the more events that have nothing to do with gaming will have an impact on the stock value. That's why we have to begin to analyze the trends of the Tokyo Stock exchange as a whole, to set the stage of our detailed analysis that will come afterwards.

Above you can see a simplified graph (without all the jaggies) of the Nikkei 225, one of the main indexes that represent the trends of the TSE. As you can see the stock market as a whole was climbing nicely during the Tokyo Game Show days, while past the event on September the 20th Standard & Poor's (an influential credit rating agency) dropped Italy's credit rating from A to A-1, lowering trust in the European economy and causing the whole stock exchange to collapse. Yesterday things didn't go much better as the Federal Reserve shown a grim outlook for the US economy, and the situation in China and Germany worsened the situation.

But let's move to our main characters for the week, the Game Publishers themselves. Again, remember that nothing in the stock exchange happens in a vacuum, so the analysis is a gross approximation that takes in account only major events and the ones related to gaming. A more precise assessment would be far too complex (and way too boring) for a gaming website.

Nintendo

On Monday we wondered if Nintendo could recover from the slump that started with their Pre-Tokyo Game Show 3DS-focused conference. As you can see in the first table above (the sizes of the two tables are different to equalize their scale and give a better idea of the trends), Nintendo's stock simply collapsed on the 13th, the day of their conference, and continued to fall, until the end of Tokyo Game show, even if it's quite evident that during the event the fall gradually slowed down until the stock price dropped only 60 Yen on Friday.

The investors evidently manifested dissatisfaction with the announcements made at the conference, but things calmed down as third parties shown several interesting titles at TGS (Nintendo doesn't traditionally participate to the event itself). Games like Monster Hunter 3G, Bravely Default, Project Mirai, Dragon Quest Monsters: Terry's Wonderland 3D and others were playable or announced at the show, acting as a parachute and restoring faith in the brand.

The start of this week shown a much better outlook for the big N, as, despite the collapse of the Tokyo Stock Exchange, Nintendo's Stock value started recovering, powered by the positive announcements mentioned above. The fact that the 3DS jumped back ahead of the PS3 on the media create hardware charts didn't hurt as well. The Wii is still weak, but no one at Nintendo seems to care about it anymore and quite evidently the investors agree.

Especially considering the opposite market trends, looks like the downward spiral has been stopped for Nintendo, and while the losses haven't fully been recovered, an increase of 250 Yen per stock in three days after such a sharp fall isn't something to be disregarded.

Sony

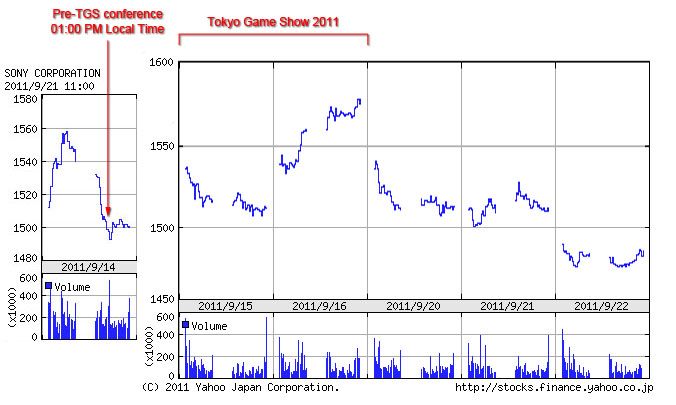

There's no doubt that Sony took Tokyo Game Show by storm thanks to the metric ton of announcements started with the PS Vita-focused conference on the 14th, that quite evidently single-handedly blocked a sharp fall in the stock price right before the closure of the market and violently propelled the trend upwards until the end of the Tokyo Game Show.

When the conference started the price was at 1487 Yen per stock, and the Vita propelled it up to 1578 in 2 days and a couple hours of trading.

Unfortunately for Sony's investors, between the game companies in Japan, Sony is the one with the most fields of operation in addition to gaming and is the one that most depends on the US and on Europe for a large percentage of it's sales. The result is that the days after Tokyo Game show followed closely the trends of the stock market in general, dropping sharply on Tuesday and yesterday as instability on overseas market hit Sony harder than anyone else, closing at 1484 Yen per stock.

While the last three days haven't been happy ones for Sony's investors, one thing is beyond any reasonable doubt. Even thanks to Vita and Tokyo Game Show Sony's stock closed just 3 Yen under the point in which the climb started. Without the PS Vita it's quite probable that the fall would be much more painful. We can safely assume that the PS Vita is at least one of the elements that kept Sony afloat in a dire economical situation.

Namco Bandai

Namco Bandai didn't do very well stock-wise during Tokyo Game Show, losing 23 yen per stock during the event. This is probably due to the fact that there were no groundbreaking announcements (as most were actually leaked or announced before the 15th). Gods Eater 2 will be a solid title, but it will also be a PSP title, which is definitely less exciting than a jump of the series on the PS Vita. Tales of the Heroes: Twin Braves suffers from the same factor, moreover when Namco Bandai teased everyone about an new Tales of title, people expected a new major JRPG on the PS3 (especially considering the sales of Tales of Xillia), not a rather obscure fighting spin-off on the PSP. Things were pretty much stable in the following three days, which is a good thing, considering the sharp drop of the Nikkei.

Konami

Konami had a lot of titles in their lineup for Tokyo Game Show, but almost everything was pretty much announced or teased long before the show and many of the titles shown were remakes (which are a good thing, but aren't exactly what normally drives stock prices to the stars). On top of this Konami wasn't too involved in the big vita launch, with some future projects but nothing really major beside a couple remakes (at least not enough to spark a lot of interest in the investors). The result is a rather lackluster performance of the stock values, that dropped by 76 yen during the show and then followed the rest of the world downwards after the event. I wouldn't be surprised if the stock value was negatively influenced by the presence at the show of FIFA12 (distributed by Sega), since lately the FIFA series is outperforming Konami's Pro Evolution Soccer series.

Square Enix

Square Enix fired almost all their shots before Tokyo Game Show, with pretty much all the PS Vita titles announced during the Sony conference and all the Wii and 3DS titles announced during the Nintendo conference. While what was shown at TGS was quite impressive, there was no shock factor, causing a 49 yen drop between the 15th and the 16th and a jump on the sliding bandwagon after the show.

Sega

Sega had three visible positive spikes during Toyo Game Show. The first and biggest started in the morning of the 15th, during the Yakuza Black Panther 2 conference with Toshihiro Nagoshi. While it's still a PSP title, Japan definitely loves the series. The Announcement of the PuyoPuyo games and the Binary Domain conference kept things heated in the early afternoon, but after that the stock price dropped visibly.

The following day the first positive spike in the morning matched quite visibly the conference that shown a recap of most of of the titles on show. In the afternoon things were kicked up to a good start with the Phantasy Star Online 2 conference and continued pretty much positively until a very sharp spike in stock value right at the end of the trading session, when FIFA12 (that Sega distributes in Japan) was shown on stage. Sega Sammy has it's hands into multiple markets, so they didn't manage to escape the general trend of the market this week.

Capcom

Capcom came to Tokyo Game Show with quite a few titles, some of which were definitely solid. The performance of their stock prices didn't really reflect that, mostly because the strongest titles (like Ultimate Marvel vs Capcom 3, Monter Hunter 3G and Street Fighter X Tekken) were showcased on stage only on the 17th and the 18th, when the stock exchange was closed due to the week end. Nothing new during the last three days, in which Capcom followed the downward trend.

Tecmo Koei

Tecmo Koei started very nicely on the 15th probably propelled by the announcement about Dead or Alive 5 the day before. Then things dropped quite sharply, probably due to the absence of events during the whole morning.

The Ninja Gaiden 3 stage conference came too late to influence trading on the 15th, but determined a strong start on the 16th, before the lack of events caused some more downward fluctuation.Right before the end of the 16th trading session the conference the Dynasty Warriors NEXT conference for the PS Vita caused a visible sharp spike.

Things didn't go as badly as for many other publishers this week, especially on the 22nd, probably thanks to the release of the first DLC of Champion Jockey. The Japanese really love their Gallop Racer games.

Marvelous Entertainment

AQ Interactive

I'm going to cover Marvelous and AQ together, due to the fact that they recently engaged in a merger, forming Marvelous AQL Inc., even if the publishing brands are still separate (for now) and stock are separately traded.

While there are some differences, the general trend is similar, with a sharp growth in stock value during Tokyo Game Show. That's not really surprising considering that the two companies jumped heavily on the PS Vita bandwagon.

AQ's stocks shown the most solid performance, thanks to the fact that they will publish one of the launch titles for the Vita (Sangokushi Touch Battle). Marvelous enjoyed the "Vita Effect" as well, since they are publishing three RPGs and one action game for Sony's new portable down the line. The effect wasn't as strong as the one on AQ's stock because specifics about the four titles are still unknown, but producing this many games for a new console is a big deal for relatively smaller players like Marvelous and AQ, so it's not surprising that the stock values climbed that sharply

Nihon Falcom

No surprise here, Nihon Falcom is another of the smaller players in the industry that received a very positive influx from announcing a game for the Vita. The positive trend lasted pretty much for the whole show, with an extremely visible spike in confidence in the afternoon of the 15th, due to the presentation and release of official assets (trailer, screenshots and information) of Ys -Foliage Ocean in CELCETA-. The return of the classic Ys franchise propelled the opening stock price upwards by 2500 yen in the morning of the 16th.

GungHo Online Entertainment

GungHo's case is very similar to Falcom's. Stocks were dropping until the presentation (and subsequent release of the official assets) of their upcoming PS Vita title Ragnarok Odyssey in the early afternoon of the 15th, that pushed the value upwards for the whole duration of the show. The price per stock increased sharply by more than 10,000 yen. Unfortunately GungHo is far more susceptible to be influenced by the rest of the market than Falcom, as a major MMORPG publisher, and the downwards trend of the global economy this week probably raised concerns about increasing operation costs, sending the value of the stocks down by quite a lot.

As you can see analyzing the trends of the stock market can be quite an entertaining game in itself. We also made a few interesting discoveries: Nintendo seems well set on the way to recovery, as the titles shown at TGS bolstered confidence of the investors (or at very least shown them than not all is lost). Sony's stock value is extremely susceptible to external influence, riding the treacherous tides of the market up and down, but the PS Vita is proving a valuable asset in staying afloat.

The big publishers were mostly fluctuating, raising as the strongest titles were shown and dropping during slower times. Investors probably expected them to show more Vita titles in a playable state. They probably also suffered from a period of relative decline of the home console market (not much was shown by them on that front).

Finally, jumping early on the PS Vita bandwagon is proving very valuable for the smaller players in the market, that are normally slower in supporting new platforms. This time they were able to join the fray early due to the affordability of the Vita development kits. This raised the confidence of investors in their future, causing their stock to generally outperform their bigger competitors across the board.